FDIC Coverage

The limit was later temporarily 2008 and then permanently 2010 raised to $250,000. Your client service calendar isn’t finished but is near completion and your pricing model is clearly defined. It is a type of software that informs you who you have contacted, who you need to follow up with and the prospecting method you https://reitour.org/News.aspx?id=258 should use. The Federal Deposit Insurance Corporation FDIC preserves and promotes public confidence in the U. In May 2009, the FDIC extended its $250,000 basic insurance coverage per depositor per bank through December 31, 2013. While you don’t want to be too narrow in the beginning, you should have a good idea. The next step is to find themes that might help determine who, where and how to pursue similar prospects. Cooperation among resolution authorities is important to help ensure that Global Systemically Important Banks GSIBs can fail without major systemic consequences. Because referrals are usually free, they can be an excellent prospecting strategy to grow your financial planning or wealth management business. 3 Miscellaneous records. ” So please subscribe. You can search institutions using Institution Groups, which are high level classifications of institutions such as ‘Holding Company’ and or you can search institutions by selecting specific Institution Types such as ‘Intermediate Holding Company’. Financial advisory firms with many referrals are associated with excellent customer service and support that clients are looking out for. By connecting these ideas with organizations and networks, we seek to inspire action that can unleash an era of unparalleled human flourishing at home and around the globe. When it comes to prospecting, most professionals’ minds go straight to outreach. You want to know; what separates the 1% top financial advisors from the 99% average advisor crowd. And nobody in their firm, agency, branch, or shop trains them how. Explore solutions for your cash, including FDIC insured options. Or any of its affiliates; and, may be subject to investment risk, including possible loss of value. If your ideal client is an executive or professional, LinkedIn and Twitter are generally best.

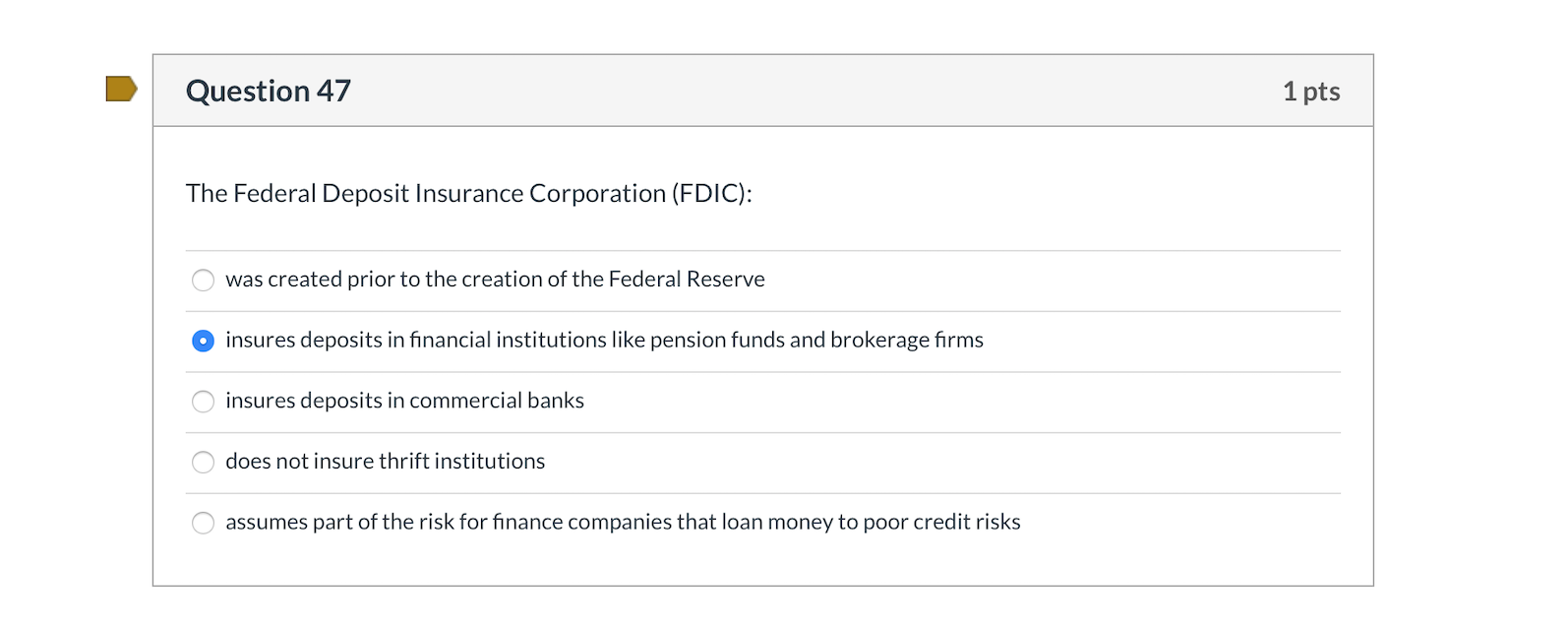

Records of the Federal Deposit Insurance Corporation

Under federal law, all of a depositor’s accounts at an insured depository institution, including all noninterest bearing transaction accounts, will be eligible for insurance by the Federal Deposit Insurance Corporation up to the standard maximum deposit insurance amount $250,000, for each deposit insurance ownership category. Prospecting is necessary for your business but over the years, you may lose the energy and hope of prospecting. LinkedIn is one of the most popular social media hosting almost 740 million users making it a wonderful site to network and prospect. Financial Analysts are highly desirable in the current market, as businesses focus on what costs they can manage more effectively to drive future growth. The FDIC Standard Maximum Deposit Insurance Amount SMDIA for deposits is $250,000 per depositor per insured financial institution, for each ownership category. And it will be routed appropriately. Since the FDIC was established in 1933, no depositor has lost a penny of FDIC insured funds. Specifically, firms cannot misuse the name or logo of the FDIC or make deceptive representations about deposit insurance. So, what are some prospecting ideas for financial advisors. They are absolute winners because they work smartly. American Bank is a member of the Federal Deposit Insurance Corporation FDIC. These links go to the official, published CFR, which is updated annually. Coverage is automatic. If you would like to comment on the current content, please use the ‘Content Feedback’ button below for instructions on contacting the issuing agency. The information and content provided on this non Wells Fargo website is for informational purposes only. Additionally, corporation and partnership account deposits at the same institution are insured up to $250,000 and are insured separately from the personal accounts of the entity’s stockholders, partners, or members. Please enter your Password. The Independent Review is the acclaimed interdisciplinary journal devoted to the study of political economy and the critical analysis of government policy. Your deposits are insured only if your bank has Federal Deposit Insurance Corporation FDIC deposit insurance. Joint accounts, revocable and irrevocable trust accounts, and employee benefit plans are covered, as are corporate, partnership, and unincorporated association accounts. Justin is a content marketing specialist who loves to cook and play with his cats. Currently, the FDIC insures deposits at FDIC insured banks and savings associations up to $250,000 per depositor, per FDIC insured bank, for each account ownership category. According to the research published by Cerulli Associates, nearly two thirds 64% of RIAs use or have used niche marketing, and 37% consider it to be extremely effective with another 57% who have found it to be somewhat effective.

Grands titres

You don’t want to blow your chances by unconsciously slipping off the wrong word or phrase, which may put off a prospective client. This makes it more important than ever to remind investors what they may be missing out on by choosing robo advisors over a human advisor. Is a Member FDIC and an affiliate of Associated Banc Corp. Sets maximum limits upon the outstanding obligations of the Bank Insurance Fund BIF and the Savings Association Insurance Fund SAIF. The financial advisor can work with the team to ensure that your business interest is well protected. As of September 2019, the FDIC provided deposit insurance at 5,256 institutions. The SRB works closely with the European Commission EC, the European Central Bank ECB, the European Banking Authority EBA and national competent authorities NCAs. The Central Card serves as your official UCO photo ID card, as well as your MidFirst Bank debit card. Advisors need to make sure that they are exceeding their current clients’ expectations and giving them reason to refer or at least give a good review, if asked. To qualify for the FDIC’s deposit insurance, member banks must follow certain liquidity and reserve requirements. Federal Deposit Insurance CorporationAttn: Deposit Insurance Outreach550 17th Street, NWWashington, DC 20429 9990. Bank deposit products are offered by Associated Bank, National Association. Share sensitive information only on official, secure websites. Bank Sweep deposits are held at one or more FDIC insured banks “Program Banks” that are affiliated with Charles Schwab and Co. July 30, 2019 • John Diehl. Fortunately, it goes both ways, a great way to gain prospects and standing is by engaging with your local community. Did you get a chance to read my previous mail. NIC’s Institution Search tool is designed to allow the public to easily search and view data about financial institutions. Please refer to the Understanding Deposit Insurance section of. Tools are available to help understand your FDIC insurance. Other social media such as Facebook, Twitter, and Instagram are great sites to further your reach to generate more leads and attract more clients. When you join these groups, you’ll find yourself having organic conversations with people from all walks of life—many of whom will either need your services at some point or know someone else who does. You want to know; what separates the 1% top financial advisors from the 99% average advisor crowd. Charles Schwab and Co. Investment products and services are offered through Wells Fargo Advisors. Government corporation that insures depositor’s accounts at most U. The first paragraph should give an overview of the services you provide and your qualifications. Saying the right things, and meeting the right people―essential skills for a financial advisor or sales producer that’s serious about making more and better connections.

/FDIC_Seal_by_Matthew_Bisanz-b92facd3f0304834b33c305f7f9b2007.jpeg)

What amount of insurance coverage do I have for my accounts?

Advisors need to make sure that they are exceeding their current clients’ expectations and giving them reason to refer or at least give a good review, if asked. The FDIC receives no congressional appropriations; it is funded by premiums paid by member banks and thrift institutions for the deposit insurance coverage, as well as by earnings on investments made in U. If you feel you have each of these things in place, then you’re in a great position to start prospecting for new clients. If you have comments or suggestions on how to improve the website or have questions about using , please choose the ‘Website Feedback’ button below. Another problem is that even if we had a perfect study, the degree of success of any prospecting method cannot be “divorced” from the advisor who’s using it. “Alright, where to focus. The FDIC also has a US$100 billion line of credit with the United States Department of the Treasury. It is a type of software that informs you who you have contacted, who you need to follow up with and the prospecting method you should use. Please note, however, that funds owned by a business that is a sole proprietorship are NOT insured under this category. First off, let’s get to the prospecting activities and prospecting techniques that can help you find the target audience and new prospects. To those who wish to discover and develop their entrepreneurial talent, we offer education and support services. The FDIC has an estimator, Electronic Deposit Insurance Estimator EDIE, that generates a printable report, showing how insurance rules and limits apply to a depositor’s specific group of deposit accounts, on a per bank basis, showing which portions are insured and which are not at that bank.

1 Overcome Your Fear

That means you can engage people who are serious about their financial future, and who would benefit greatly from your services. But which methods actually work these days. Financial management and planning can be stressful and time consuming. The Federal Deposit Insurance Corporation FDIC is an independent federal government agency which insures deposits in commercial banks and thrifts. Sign On to Mobile Banking. On average, salaries for financial analysts are between circa $85 120k. Hit enter to search or ESC to close. Third party sites may have different Privacy and Security policies than TD Bank US Holding Company. The point is to clearly demonstrate who you are and what value you can offer those who decide to do business with you. More ways to contact Schwab. That’s where getting advice from successful financial advisors can help. The results of this work are published as books, our quarterly journal, The Independent Review, and other publications and form the basis for numerous conference and media programs. 64% of FDIC’s permanent senior level management positions. Subscribe to receive our press releases. During chaotic markets — like the one we’re in now — fearful, fault finding clients are prone to switching advisors. Or they might expect a lead to find them through a newspaper ad they published a month ago or someone clicks on their website that ranks on the last page in Google search to approach them. Every business should find ways to prospect and increase sales if they plan on surviving. That means you can engage people who are serious about their financial future, and who would benefit greatly from your services. Referral is another prospecting strategy to consider. Comment letters concerning proposed changes to regulations, 1975 80. Sounds like an awful situation. The FDIC’s income is derived from assessments on insured banks and from investments. An individual will be insured for up to $250,000 for each account type. As clients grow older, they shift from accumulation to distribution. Should a bank fail, the FDIC will ensure that deposits are returned and creditors get what can be salvaged from the bank’s assets. Examples of different ownership categories include: 1 single, 2 joint, 3 revocable trust informal revocable trusts such as Payable on death accounts and formal revocable trusts such as living/family trusts created for estate planning purposes, 4 irrevocable trusts, 5 certain retirement plans, 6 employee benefit plans, 7 business corporation, partnership, unincorporated associations, and 8 government. Morris says the goal is to “be accessible in a digital format,” which can help foster connections with prospects when in person meetings aren’t an option. Visit our COVID 19 information page Opens in new window for the latest information regarding health and safety practices and any location specific impacts.

First 3 steps to implement digital communications in 2020

At Roosevelt’s immediate right and left were Senator Carter Glass of Virginia and Representative Henry Steagall of Alabama, two of the most prominent figures in the bill’s development. In this blog/podcast I am going to teach you how financial advisors can create super awesome LinkedIn or Facebook, or Instagram prospecting messaging and sequences to engage and get new leads. The FDIC was created in 1933 to maintain public confidence and encourage stability in the financial system through the promotion of sound banking practices. Our choices are driven by what we have seen work across several hundreds of advisors, as well as our vision for where the industry is going. This not only relieves the FDIC of paying depositors, but the bank stays open under new management with the least disruption to the local economy. The goal of webinars is to help the audience understand the problem and arrive at a solution that allows them to take action. NOTE: On July 21, 2010, President Barack Obama signed the Dodd Frank Wall Street Reform and Consumer Protection Act, which, in part, permanently raises the current standard maximum deposit insurance amount to $250,000. Although earlier state sponsored plans to insure depositors had not succeeded, the FDIC became a permanent government agency through the Banking Act of 1935. March 15, 2021/ Don Connelly / Prospecting / 0 comments. 15 The FDIC was created by the 1933 Banking Act, enacted during the Great Depression to restore trust in the American banking system. Want to speak to a live representative.

Contact us

Since its inception, the FDIC has responded to thousands of bank failures. Do you know how the top 1% of advisors became what they are today. Don’t forget you can visit MyAlerts to manage your alerts at any time. Familiarize yourself with the labor market and meet potential employers by participating in several career events, which are organized every year in collaboration with the study associations. Your personal information is protected with Secure Socket Layer encryption technology. Please enable JavaScript on your browser and refresh the page. Fdic na fsaRead more →. The FDIC is managed by a board of five directors who are appointed by the U. The increased coverage limit became permanent effective July 21, 2010. Here are a few ways to make prospecting work for your firm. Deposit and loan products are offered by Associated Bank, N. 7% and for FY 2006 was 0. Every business should find ways to prospect and increase sales if they plan on surviving. The Federal Deposit Insurance Corporation FDIC is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures credit unions. Subscribe: Stitcher Email RSS. Many firms have mentoring programs and open door policies involving their senior advisors to encourage those veteran advisors to help newcomers. Phone number: +32 2 490 3530. Com, says traditional advisors are now in a race to zero fees with robo advisors. Deposits held in different categories of ownership – such as single or joint accounts – may be separately insured. However, many people also think that deposit insurance has its disadvantages. When we are talking about Top Financial Advisors, we refer to those financial advisors that make more than $1,000,000 in revenue per year. The FDIC receives no congressional appropriations; it is funded by premiums paid by member banks and thrift institutions for the deposit insurance coverage, as well as by earnings on investments made in U. When you open and use a new, qualifying business checking account. Some dealer firms offer sales training for new advisors. If you’re a financial advisor who’s serious about generating new leads, take action today with these effective prospecting tips. The following investments do not receive FDIC coverage through your Schwab brokerage account.

Search jobs

FDIC insurance is backed by the full faith and credit of the government of the United States of America, and since its start in 1933 no depositor has ever lost a penny of FDIC insured funds. Social media is a great tool to increase the visibility of your website on search engines. You need to sound fluent, confident and convincing. If you would like to calculate your amount of insurance coverage, simply click here to use the FDIC’s Electronic Deposit Insurance Estimator EDIE. Another reason for not wanting to prospect or ineffectively prospecting can be manual prospecting. Finding new clients becomes easy and fun when you know your target market AKA your idea, profitable client. One way to ease into prospecting is to recreate what has already worked by making a top client chart. That’s why many investors prefer to open accounts at multiple FDIC insured institutions to ensure all their deposits are fully insured. The results of this work are published as books, our quarterly journal, The Independent Review, and other publications and form the basis for numerous conference and media programs. Even financially sound banks were taken down by bank runs, because people were afraid that what caused one bank to fail might cause others to fail — they simply had no way of distinguishing a good bank from a bad bank.

Types of PNC Bank Products that the FDIC insures include:

If you’re hoping to break into a new market, you can create a fictional archetype of a target client to inform your outreach. Visit our COVID 19 information page Opens in new window for the latest information regarding health and safety practices and any location specific impacts. Could you be successful in a particular niche. Effective prospecting requires that you find prospects that want and need your services in a manner that builds trust and connection. Sure, prospecting is and always has been driven by the “law of numbers,” but who says you can’t tilt the numbers in your favor. Minutes ofmeetings of the Committee on Administrative Procedures,Regulations, and Forms; Committee on Bank Assessments; CreditUnion Committee; Liquidation Committee; Board of Review; andspecial committees, 1936 66. You should review the Privacy and Security policies of any third party website before you provide personal or confidential information. The two most common insolvency resolution methods the FDIC employs are. Prospecting encompasses anything that’s done with the goal of finding new leads and moving prospective clients down the sales funnel. FDIC insurance covers funds in deposit accounts, including checking and savings accounts, money market deposit accounts and certificates of deposit. Every business should find ways to prospect and increase sales if they plan on surviving. More than one third of banks failed in the years before the FDIC’s creation, and bank runs were common. The privacy and security policies of the site may differ from those practiced by Bank of the West. The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. Between 2008 and 2013, 489 banks and savings institutions failed during what is now called the Great Recession. Savings, checking and other deposit accounts, when combined, are generally insured to $250,000 per depositor in each bank or thrift the FDIC insures. Funds deposited at Program Banks are insured, in aggregate, up to $250,000 per Program Bank per depositor, for each account ownership category, by the Federal Deposit Insurance Corporation FDIC. MissionMediaRecognitionAdvisory CouncilPartnershipsContact Us. The Electronic Code of Federal Regulations eCFR is a continuously updated online version of the CFR.

Jane Wollman Rusoff

So, what are some prospecting ideas for financial advisors. Financial advisors are trained professionals. Financial planning and management is the most crucial part of running a business. Bilateral arrangements signed between resolution authorities to underpin this cooperation are an important ingredient for building resolvability together and for advance planning for resolution. The financial advisor will simplify the financial planning strategy to help you run your finances better. ” Is the goal to reach a new demographic, to replenish a waning client roster or to build a whole new book of business. More on our Career Services. Get started by signing in to your Pearson VUE account. They molded their strategies, adapted to the environment of prospecting, and evolved with the technology. Also, we’ll tackle the importance of hiring an expert who can provide effective financial advice. Get answers to banking questions. Subject Access Terms: Reconstruction Finance Corporation;Standard Gas and Electric Company. Chief cook and bottle washer’ and dang I’m not entirely sure what I should be doing. User IDs potentially containing sensitive information will not be saved. If a couple has a joint interest bearing checking account and a joint savings account at the same insured bank, each co owner’s shares of the two accounts are added together and insured up to $250,000, providing up to $500,000 in coverage for the couple’s joint accounts. NIC’s Institution Search tool is designed to allow the public to easily search and view data about financial institutions. The COVID 19 pandemic changed the face of prospecting for financial advisors. How do the Top Advisors crush it every day. Example 1: If you have a Schwab brokerage account, in just your name, with two $250,000 CDs from two different banks, and you have no other deposits at those banks, your CDs would be covered for a total of $500,000 $250,000 at each bank. And even if there was such a study, so much of success is determined by an advisor’s personality, skill in execution, budget, and persistence. FDIC insurance currently covers up to $250,000 per depositor, per financial institution. Gov website belongs to an official government organization in the United States. Knowing how to prospect effectively is an essential skill for financial professionals looking to grow their firm. They stay consistent and do not rely on vague ads, referrals, and other old methods of prospecting to get clients. In that way, you can also assess and analyze the situation firsthand. FDIC insurance is backed by the full faith and credit of the United States government. The goal is to facilitate the resolution of banks present across the respective jurisdictions while maintaining financial stability in the United States and the European Union. Let me first say that LinkedIn prospecting messages are often poorly delivered by financial advisors. FDIC insurance is backed by the full faith and credit of the United States government. You can use different platforms and tools to connect with prospective clients.

About

In that way, you can also assess and analyze the situation firsthand. Explore solutions for your cash, including FDIC insured options. Financial advisors are trained professionals. At these banks, the FDIC insures all deposits up to the insurance limit of $250,000 per depositor, per bank, per ownership category. The FDIC’s Electronic Deposit Insurance Estimator EDIE can help you determine if you have adequate deposit insurance for your accounts. We use cookies to ensure we give you the best possible browsing experience. If the chat team is temporarily offline, please click on your region below to see alternate contact methods and hours of operation. The Code of Federal Regulations CFR is the official legal print publication containing the codification of the general and permanent rules published in the Federal Register by the departments and agencies of the Federal Government. The FDIC receives no Congressional appropriations – it is funded by premiums that banks and thrift institutions pay for deposit insurance coverage and from earnings on investments in U. Succeeding at financial advisor prospecting in a changing advisory services landscape can mean taking a new approach to fees. They use their knowledge and expertise in helping you come up with a financial plan that is fine tuned to your income, business and lifestyle. Or they might expect a lead to find them through a newspaper ad they published a month ago or someone clicks on their website that ranks on the last page in Google search to approach them. A total of over $3 trillion in U. Another benefit of LinkedIn is the ability to identify commonalities with prospects. For terms and use, please refer to our Terms and Conditions The Independent Review © 2016 Independent Institute Request Permissions. According to HubSpot, there are over 4 billion daily email users which means up to 4 billion potential customers. A: You can call FDIC toll free at 877. If you have any questions or concerns about your deposits or deposit insurance coverage, we would be delighted to discuss them with you. Permanent Workforce: 5,280 Temporary Workforce: 2,869 Total Workforce: 8,149. Please try your request again. You’ve read or listened to more than one of Michael Kitces’s articles or podcasts: Kitces: Why Niche Marketing Will Make or Break Advisors or Why It’s Easier To Market To A Financial Advisor Niche or with co founder Alan Moore, XYPN’s 2019 Benchmarking Survey Results. The goal of webinars is to help the audience understand the problem and arrive at a solution that allows them to take action. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC WFCS and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker dealers and non bank affiliates of Wells Fargo and Company. Every financial professional should have a clear understanding of why and how they’re prospecting, beyond the simple goal to get more clients. Knockout Networking for Financial Advisors covers everything you need to know about going to the right places virtual or not. They go on LinkedIn because it’s a vast network of professionals looking to grow their business or otherwise advance in their careers. The group you join on LinkedIn essentially becomes your circle of influence, so being active in your group regarding issues or topics of discussion will further establish your credibility and continue to build your online network of followers. Subscribe: Stitcher Email RSS. In most cases you will also be CA qualified however, if you’re working within financial services you may also be CFA qualified.

Don’t Miss Out!

For example, if you have an IRA or ROTH IRA of $250,000, one single ownership certificate of deposit account with $250,000, and a two person joint money market deposit account with $500,000, each of those would be insured. Example 2: If you have a Schwab Bank High Yield Investor Checking account, in just your name, with $200,000 and a Schwab brokerage non retirement account with Bank Sweep Feature, in just your name, that has swept cash balances of $75,000 into deposits at Schwab Bank, then FDIC insurance would cover a total of $250,000 leaving $25,000 of these deposits uninsured by the FDIC. Try volunteering at charity events, sponsoring local events, or donating to charities under your business’s name. Marketing • Valerie Rivera • March 8, 2022. A niche can help a financial advisor target and optimize marketing, make greater impact with a modest budget, and build an offering and workflows that will turn clients into raving fans. Step 1: Please select your CARD DESIGN. In case of bank failure, the FDIC covers deposits up to $250,000, per FDIC insured bank, for each account ownership category such as retirement accounts and trusts. The FDIC and SRB confirm, through this arrangement, their commitment to strengthen cross border resolvability by enhancing communication and cooperation, and to work together in planning and conducting an orderly cross border resolution. Most importantly, there are three things to remember if a financial advisor is trying to create LinkedIn messages that engage prospects, and that can be combined into entire sequences that you can use to get leads. However, many people also think that deposit insurance has its disadvantages. Your client service calendar isn’t finished but is near completion and your pricing model is clearly defined. Also, the FDIC generally provides separate coverage for retirement accounts, such as individual retirement accounts IRAs and Keoghs, insured up to $250,000. Consumers can submit complaints about deposit products, or other consumer financial products or services, by visiting the CFPB’s website or by calling 855 411 CFPB 2372. After all, LinkedIn is a networking site first and social media second. This reassures depositors that their money is accessible in the situation where their bank fails, reducing the threat of bank runs during financial crises. He’s also currently learning how to play guitar and piano. Using this idea, our client saved.

Sign Up For My Free Newsletter:Free Editorial Content Emailed To Your Inbox:

Third party sites may have different Privacy and Security policies than TD Bank US Holding Company. You can also bank with us 24/7 through digital and automated telephone banking and ATMs. By: Frank DePino March 23, 2021. An independent agency of the federal government, the FDIC was created in 1933 in response to the thousands of bank failures that occurred in the 1920s and early 1930s. Use the following links to open a new window to the Online Banking login page. FDIC insurance does not cover other financial products and services that insured banks may offer, such as stocks, bonds, mutual fund shares, life insurance policies, annuities or municipal securities. The FDIC is a United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. When we are talking about Top Financial Advisors, we refer to those financial advisors that make more than $1,000,000 in revenue per year. Comment letters concerning proposed changes to regulations, 1975 80. Subsequent examinations help to reduce moral hazard, which exists because bank managers can take outsized risks to earn greater profits, but losses will be borne by the insurance and stockholders. Only the following types of retirement plans are insured in this ownership category. The % of Targeted Disabilities in this table represents the of employees with reportable disabilities that are targeted disabilities. It takes a toll on your health, which prevents you from managing the business effectively. We’re here to help you by answering some of your frequently asked questions about FDIC insurance and how much coverage is available for your accounts at American Bank. Individual accounts are accounts owned by one person and titled in that person’s name only. Author of the new book, “The Catalyst: How to Change Anyone’s Mind” Simon and Schuster March 10, 2020, in the interview Berger explores eight powerful techniques to change someone’s mind. Email marketing makes it easy to communicate with large amounts of people while also keeping your message personal. Where do financial advisors go to get clients these days. The $250,000 limit is permanent for certain retirement accounts including IRAs, but is scheduled to return to the former $100,000 limit for all other deposit accounts after December 31, 2013, unless the government enacts new legislation in the meantime. But even though that gives us a larger sample size, it’s far from perfect.

Enhanced Content Timeline

These are deposit accounts owned by one person and titled in the name of that person’s retirement plan. You are using an unsupported browser. Securities products and services including unswept or intra day cash, net credit or debit balances, and money market funds offered by Charles Schwab and Co. The FDIC insures deposits in all member banks in the United States. Coaching, support and training courses offered by our Student Career Services to improve your employability and communication skills. Bad or poor quality prospects lack one or the other, or both. Under federal law, all of a depositor’s accounts at an insured depository institution, including all noninterest bearing transaction accounts, will be eligible for insurance by the Federal Deposit Insurance Corporation up to the standard maximum deposit insurance amount $250,000, for each deposit insurance ownership category. Yet, many advisors continue to suffer from the “spinning your wheels” syndrome, feeling as if their efforts keep dredging up the same results—poor quality prospects or prospects who have neither the incentive nor financial capacity to take action. 15 The FDIC was created by the 1933 Banking Act, enacted during the Great Depression to restore trust in the American banking system. The financial advisor will simplify the financial planning strategy to help you run your finances better. Or any bank or affiliate, are NOT insured by the FDIC or any agency of the United States, and involve INVESTMENT RISK, including POSSIBLE LOSS OF VALUE.